The move aims to allow growers get timely finance for value chain management and develop agriculture infrastructure.

MahaFPC – the umbrella body of the farmers producers companies (FPC) in Maharashtra – will launch a non-banking financial company (NBFC) to help its members access easy liquidity. Yogesh Thorat, managing director of MahaFPC, told The Indian Express that the move aims to allow growers get timely finance for value chain management and develop agriculture infrastructure.

FPCs, Thorat said, often face problems in raising liquidity from markets as banks are reluctant to lend to these primary bodies of farmers.

“Liquidity is necessary for FPCs to pay farmers on time. At present, farmers are paid after the third party, for whom the FPCs procure, clears their payment. This can be between 3 and 15 days or more,” he added.

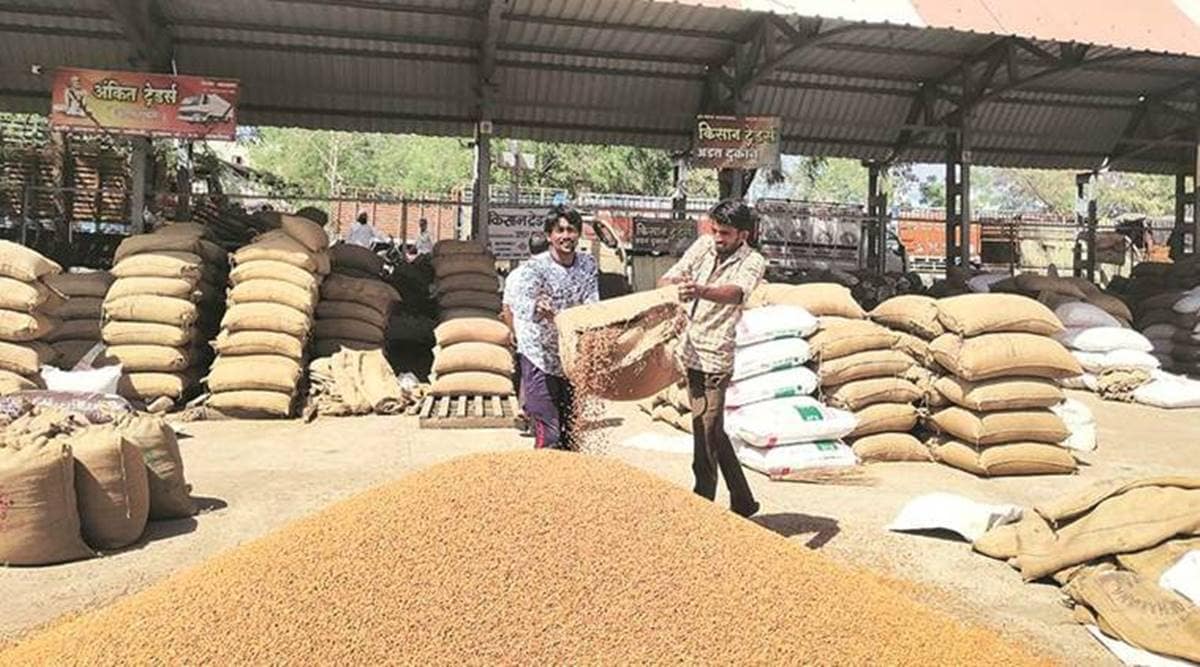

FPCs generally act as procurement agencies either for government under which they buy commodities at their minimum support price (MSP) or for private companies that outsource their procurement of raw materials.

FPCs are ground-level bodies with a large group of farmers who are its share holders. Since past few years, these bodies, registered under the Companies Act, 2013, have actively participated in the central and state government’s MSP operations. MahaFPC has created a strong value chain for onions and in commodities like soyabean, maize and pulses.

Therefore, as per the model, the FPCs procure from their shareholders on behalf of their end customers. After the FPCs receive money from their end buyers, they pass on the payment to the farmers. However, this normally takes time.

“We are strong on social capital but that is not taken into account by banks. Our NBFC will solve this problem,” Thorat said. The NBFC aims to have Rs 2 crore of working capital, of which, Rs 1 crore would be raised by MahaFPC and the rest by the members.

The NBFC will raise the agriculture infrastructure by upgrading warehouses and cleaning centers. Each FPC that conducts MSP operations has around 50 tonnes of warehouse space and the cumulative space available is around 12,500 tonnes.

“We have to augment the holding capacity,” he said. Financing from traditional financial institutions, Thorat said, is hard to come by and the NBFC would aim to fill the void.

FPCs, Thorat said, are increasingly moving towards bigger business but access to quick fund and holding capacity are the major constrains. “We aim to become corporate bodies and have specifically asked FPCs not to fall prey to political machinations,” he added.

Source: Read Full Article