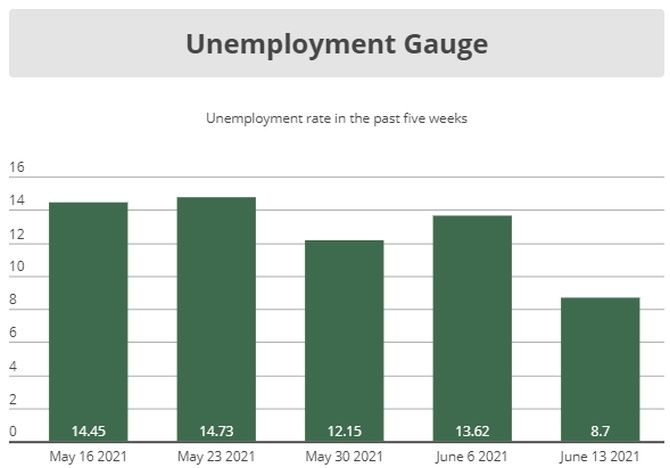

In the week ended June 6, only 2.3 per cent of the households reported that their incomes were higher than a year ago.

This was the lowest-ever proportion of households reporting an increase in income in any week, reveals Mahesh Vyas.

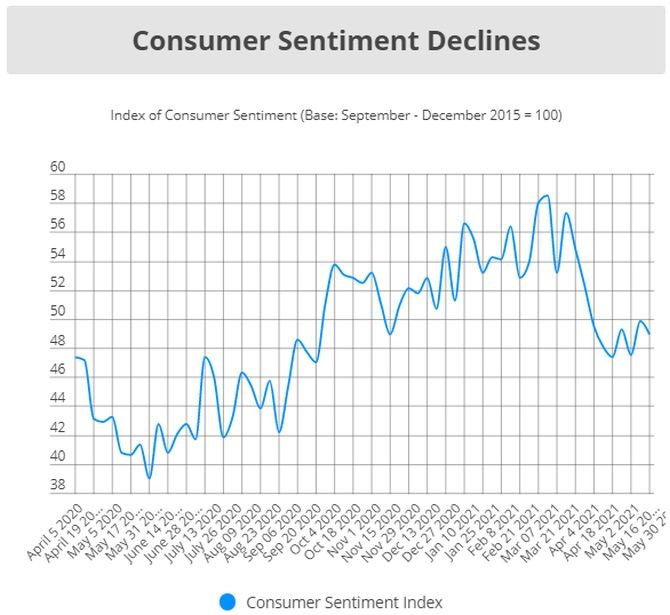

In May 2021, the index of consumer sentiments fell by a massive 10.8 per cent compared to its level in the previous month, April.

This was after the 3.8 per cent fall it had registered in April.

The cumulative fall in the index over the past two months, therefore, was a substantial 14.1 per cent.

These are the months when the second wave of COVID-19 infections was at its worst.

Evidently, the harrowing experience of households across India during these months had a telling impact on consumer sentiments.

The index of consumer sentiments has two broad components — the index of current economic conditions and the index of consumer expectations. Both declined sharply during April and May 2021.

The cumulative decline in the current economic conditions was 16.1 per cent and that in consumer expectations was 12.9 per cent.

The index of current economic conditions fell 13.9 per cent in May alone.

This reflects a worsening of perceptions regarding household incomes and also, deterioration in household perceptions regarding the purchase of consumer durables.

Perceptions on both counts were overwhelmingly negative in May.

Household perceptions regarding their incomes compared to a year ago deteriorated rather sharply during May.

Only 3.6 per cent of households reported an increase in nominal income compared to a year ago.

This was the lowest-ever proportion of households reporting an increase in income in any month.

During the four weeks of May, this proportion was as follows — 3.6 per cent in the week ended May 9; 3.1 per cent in the week ended May 16; 4 per cent in the week ended May 23; and 3 per cent in the week ended May 30.

In the week ended June 6, only 2.3 per cent of the households reported that their incomes were higher than a year ago.

This was the lowest-ever proportion of households reporting an increase in income in any week.

The second wave has also partly reversed a steady improvement in perceptions regarding purchase of consumer durables.

In April 2021, about 48 per cent of the respondents said that these were worse times to buy consumer durables compared to a year ago.

In May 2021, this proportion shot up to 55 per cent. Only 3 per cent believed that this was a better time to buy durables.

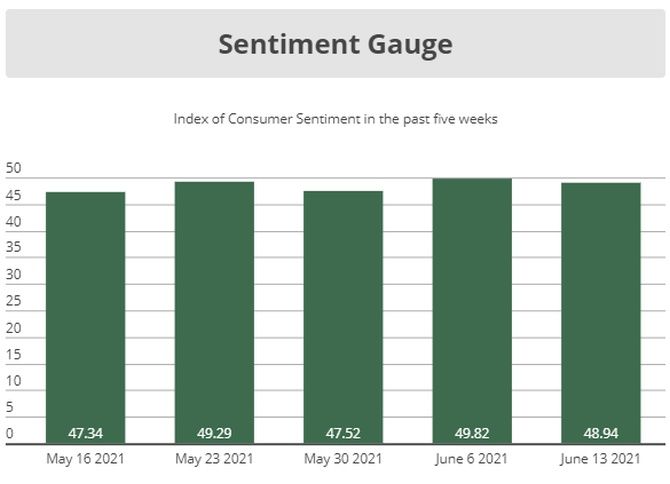

While April and May saw consumer sentiments come crashing down, it seems that a turnaround is also underway.

The index of consumer sentiments seems to have bottomed out in mid-May. The index was at 47.3 in the week ended May 16.

Since then it has clawed back some ground to reach 48.9 in the week ended June 13.

The turnaround is perceptible, but hesitant. It is also not uniform across rural and urban India.

Rural and urban India moved somewhat differently during peak months of the second Covid wave. But, both ended with substantial erosion of sentiments by the end of May.

Urban sentiments tanked 9.6 per cent in April but rural sentiments fell by a modest 0.9 per cent in the month.

In May, urban sentiments recovered 1.5 per cent but now, rural sentiments plummeted 17 per cent.

The cumulative effect of both months on consumer sentiments in the two regions has been negative. But, rural India has done much worse than urban India.

The cumulative fall in consumer sentiments in urban India during the months of April and May was 7.9 per cent. In the case of rural India, that fall is much larger at 17.7 per cent.

This much larger fall in consumer sentiments in rural India is in sync with the general view that the spread of the virus in rural India coupled with poor health facilities and the lack of vaccines could have caused much larger damage to lives and livelihoods there.

In a way, the consumer sentiment indices quantify this difference. Between March and May, consumer sentiments in rural India fell more than twice as much as in urban India.

Rural India turned quite negative on the future. Its index of future expectations fell by 15.3 per cent in May.

The cumulative fall in its index of future expectations in April and May was a substantial 16.9 per cent.

Urban India’s outlook on the future is different. After falling by 10.4 per cent in April, it recovered by 3.5 per cent in May.

As a result, the cumulative fall in the index of future expectations of urban India during April-May 2021 works out to 7.3 per cent.

As the fall in consumer sentiments in April-May was essentially a rural phenomenon, its recovery also seems to be playing out in rural India.

The recent recovery in the index of consumer sentiments that can be discerned from the middle of May is essentially a rural phenomenon.

The week ended May 16 recorded a recent low in the index of consumer sentiments.

In the four weeks since then, ie, by the week ended June 13, the index for rural India had shot up by 11.4 per cent while that for urban India fell by 9 per cent.

The recovery, of course, has a long distance to cover before it reaches its pre-second wave levels seen in February or March 2021 — and much more to reach the pre-first wave levels.

Mahesh Vyas is MD & CEO, CMIE P Ltd.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article