Analysts said the Future-RIL deal had created a hindrance for Amazon’s plans to tap offline retail and opened up huge opportunities for RIL.

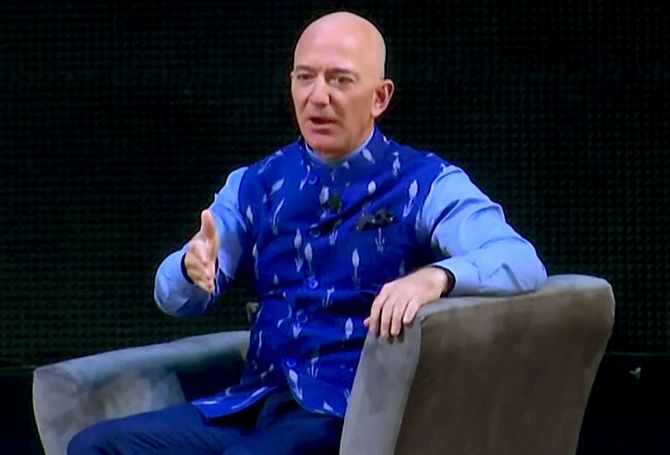

The arbitration proceedings between Jeff Bezos-led Amazon and Kishore Biyani-headed FutureGroup have begun in Singapore.

An emergency arbitration hearing between Amazon and retail conglomerate Future Group took place last week and a verdict is expected in the next few days, according to sources.

The hearing took place at the Singapore International Arbitration Centre (SIAC).

This follows a dispute over Future’s sale of its retail and wholesale businesses to Mukesh Ambani-led Reliance Industries Ltd (RIL).

Amazon had sent legal notice to Future, alleging the retailer’s Rs 24,713-crore asset sale to RIL breached an agreement with the American e-commerce giant.

The matter was heard by former Singapore attorney general V K Rajah on October 16, according to sources.

He was the sole arbitrator in the Amazon vs Future vs Reliance arbitration case.

Rajah had also served as judge at the Appeal of the Supreme Court.

The hearing is said to have lasted five hours.

It has been reported that Gopal Subramanium, senior counsel who had served as Solicitor General of India, appeared for Amazon.

Singapore-based Davinder Singh appeared on behalf of Future Coupons, one of Future’s unlisted firms.

Harish Salve appeared for Future Retail (being acquired by RIL).

Amazon did not respond to queries related to this matter.

Earlier, the Seattle-based company had said Future did not seek its permission before striking a deal with RIL.

Analysts said the Future-RIL deal had created a hindrance for Amazon’s plans to tap offline retail and opened up huge opportunities for RIL.

Only 7 per cent of the $1.2-trillion retail market is online, and players including Amazon, Flipkart, and Reliance’s JioMart are competing with one another and eyeing the remaining 93 per cent, according to analysts.

Due to foreign direct investment (FDI) regulations, Amazon cannot directly acquire assets, according to analysts.

They said Amazon was doing smaller deals with players such as Shoppers Stop and Future and working as a partner.

“Amazon is trying to get more offline assets so that when there are changes in FDI, they are in a better position to acquire these assets,” said Satish Meena, a senior forecast analyst at Forrester Research.

“For Reliance, the deal with Future increases its grocery market share to almost 40 per cent,” he added.

Last year in August, Amazon bought a 49 per cent stake in Future Coupons for Rs 1,430 crore.

Future Coupons owns 7.3 per cent in Future Retail.

The deal had a few conditions including a “non-compete” clause and “right of first refusal” (RoFR) clause, which meant Future could not sell its shares without approval from Amazon.

The RoFR gave Amazon the right to be the first to invest in Future Retail if Future decided to sell its shares.

But there is another clause that mentioned that Future could not sell its assets without Amazon’s approval.

According to sources, there is a non-compete clause, due to which Future Group could not do the deal with certain specific competing parties without speaking to Amazon.

Future Group founder Kishore Biyani recently made his first public appearance since selling his retail assets to Reliance.

He said he had no option but to exit the business in the face of mounting debt and revenue losses, triggered by the pandemic and lockdown.

He said the company lost Rs 7,000 crore in revenue in the first three-four months of the pandemic phase.

Photograph: Karma Sonam Bhutia/ANI Photo

Source: Read Full Article