The rate cut comes at a time when the Indian economy is facing its worst slowdown since the dip in economic activity following the global financial crisis of 2008-09.

The Reserve Bank of India (RBI) Friday lowered its key lending rate or the repo rate by 0.25 per cent — from 5.40 per cent to 5.15 per cent — on Friday in its fourth bi-monthly policy review. This is the fifth straight cut in its rates by the RBI in 2019 in a bid to reduce borrowing costs for home and auto loans.

After the first-quarter GDP growth rate slid to 5 per cent, the RBI has also lowered the GDP growth forecast for the current fiscal — from its earlier estimate of 6.9 per cent to 6.1 per cent.

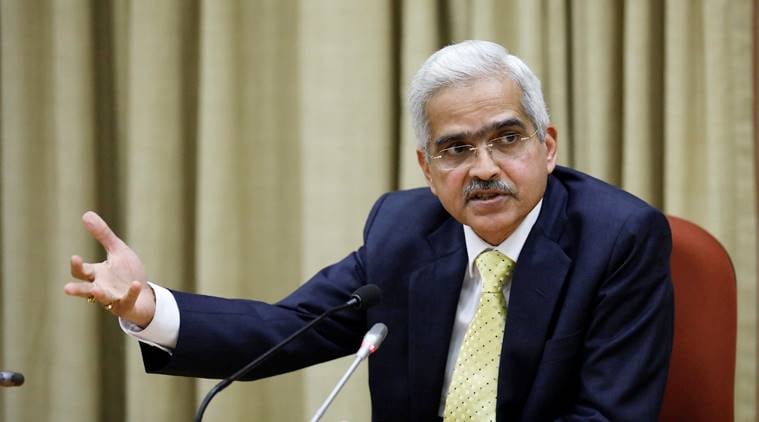

RBI Governor Shaktikanta Das said that government’s stimulus measures will help strengthen private consumption and spur private investments. Indicating that monetary transmission has been staggered and incomplete, he said,” RBI maintains accommodative policy stance with a view to reviving growth.”

“RBI marginally revised up retail inflation forecast to 3.4% for Q2, but retains estimates for H2 at 3.5-3.7%,” Das added.

The announcements from the six-member Monetary Policy Committee (MPC) came after a three-day meeting. The rate cut comes at a time when the Indian economy is facing its worst slowdown since the dip in economic activity following the global financial crisis of 2008-09.

This year, the government announced a series of measures including cut in corporate tax, rollback of enhanced surcharge on Foreign Portfolio Investors, among others to jump-start growth which hit a six-year low of 5 per cent during the first quarter of the current fiscal, its slowest pace since 2013. Inflation in August accelerated to a 10-month high but remained well below the central bank’s medium-term target of 4% for a 13th straight month.

Meanwhile, Sensex today opened with a gain of over 250 points to trade at 38,350 and Rupee inches 10 paise against the USD to trade at 70.78.

Source: Read Full Article