The Centre has tried to lower cost of capital through policy measures and steps aimed at attracting foreign funds to trigger investment cycle.

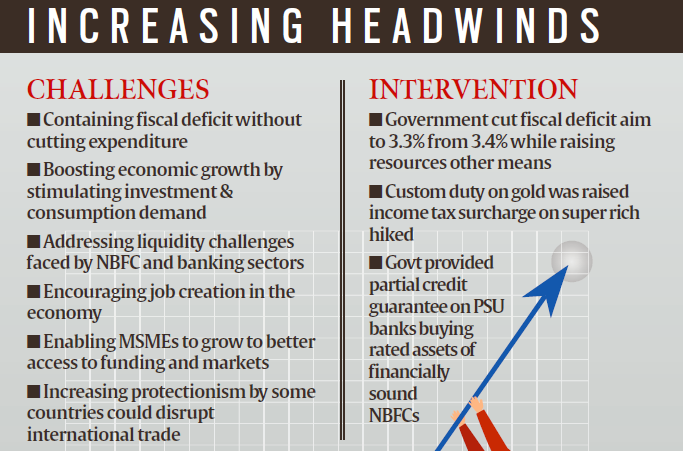

Against market expectations of government boosting spending to push growth, the Centre not only stuck to the fiscal consolidation path but also lowered the deficit target compared to the Interim Budget.

Even as it pursued fiscal prudence, the government has tried to lower cost of capital through policy measures and steps aimed at attracting foreign funds to kickstart the investment cycle. Analysts note that it will be challenging for the government to meet the target as growth is expected to remain slow.

Union Budget 2019 Highlights: From startups to Space programme

Fiscal deficit, which is the difference between government expenditure over revenues, is pegged to fall to 3.3 per cent of gross domestic product (GDP) in 2019-20 as against the Interim Budget aim of 3.4 per cent. Assumptions of stronger nominal GDP growth of 12 per cent, higher tax revenues, and extra resource raising through disinvestment and transfer of dividend from the RBI are seen as leading the improvement in the fiscal math. Changes in custom duties and excise are expected to yield additional revenue of Rs 25,000 crore while the net gain through direct taxes will be around Rs 6,000-7,000 crore.

The reduction in fiscal deficit target, along with government’s plan to raise sovereign borrowings in international markets, led to rise bond prices and yield on benchmark bonds falling as much as 10 basis points Friday. A lower deficit is typically seen as freeing up resources for investment by the private sector, which can enhance growth. While keeping government spending under check, Finance Minister Nirmala Sitharaman announced steps to improve access to capital. “We recognize that investment-driven growth requires access to low cost capital. It is estimated that India requires investments averaging Rs 20 lakh crore every year ($300 billion a year). A number of measures are proposed to enhance the sources of capital…,” she said.

In the backdrop of private sector investment remaining tepid, the Budget measures have focussed on attracting foreign capital to push investment and growth.

The proposed measures include greater funding access to companies through corporate bond market, permitting foreign portfolio investors (FPIs) to buy debt paper of infrastructure debt funds, opening up FDI in aviation, media and insurance sectors, 100 per cent FDI for insurance intermediaries, and increasing the statutory limit for FPI investment in a company from 24 per cent to sectoral foreign investment limit, improve access to NRIs to Indian equities.

Fisc in control, over to RBI now

The government has chosen fiscal prudence over expansionary policy to stimulate the economy. The conservative stance is good for bond markets and for private players, as lesser government borrowings opens up space for the private sector to raise funds domestically. At a time when the economy is on a slide, and private sector sentiments remain depressed, the government has chosen to depend on monetary tools such as repo rate cuts to boost growth.

Finance Secretary Subhash Chandra Garg said in a press briefing that the fiscal deficit target is realistic. “On the revenue side as compared to actual of 2018-19, direct taxes are expected to increase by 17.5 per cent, indirect taxes are going up by only 15 per cent. This is very realistic targets in our judgement. On non-tax side, there is also an increase as we are expecting better dividends,” he said. The government has projected dividends from the RBI, nationalised banks and financial institutions to rise 40 per cent in 2019-20 to Rs 1.06 lakh crore while disinvestment receipts are pegged to increase by 31 per cent to Rs 1.05 lakh crore.

Among the expenditure heads, interest payments and subsidies are among the major items. The government’s subsidy bill on food, fertiliser and fuel is estimated to go up by 13.32 per cent to Rs 3,01,694 crore in the current fiscal, while interest payments are projected to rise by more 12.40 per cent to Rs 6.60 lakh crore (or 33.7 per cent of revenue receipts.

Source: Read Full Article